lillianr539982

About lillianr539982

Budget Information To Nyc Home Renovation Cost Per Sq Foot

Whether it’s a kitchen, toilet, or full rework – we’re right here to make your dream home a actuality. With 20+ years of experience, licensed contractors, and a reputation for excellence, we convey your concepts to life.

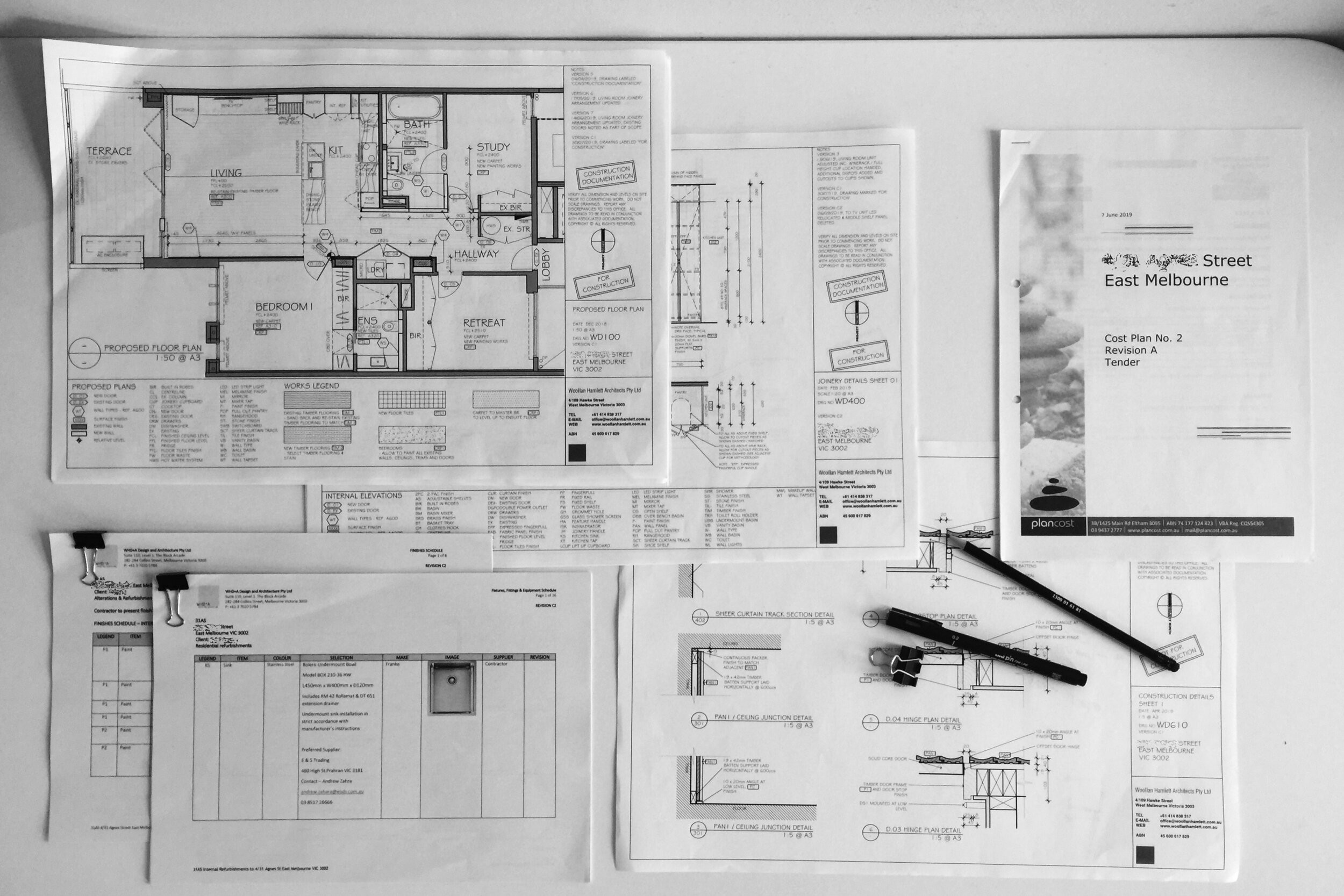

With 20+ years of experience, licensed contractors, and a reputation for excellence, we convey your concepts to life. Whether you’re dreaming up a brand new build or reimagining the home you already love, YoungBuild is here to make the process feel simple, Webpage sensible, and tailor-made to you. With a fully drawn flooring plan, inside renders, curated inclusions, and clear pricing, this ready-to-build house is the proper mixture of thoughtful design and real-world practicality.

Whether you’re dreaming up a brand new build or reimagining the home you already love, YoungBuild is here to make the process feel simple, Webpage sensible, and tailor-made to you. With a fully drawn flooring plan, inside renders, curated inclusions, and clear pricing, this ready-to-build house is the proper mixture of thoughtful design and real-world practicality.

They make use of their data via our unique Design-Plan-Construct course of to streamline an environment friendly, gratifying renovation journey. It is important that every one events have an open dialogue during the design and full construct. At this meeting we will assess whether you’ll need a constructing consent. Founder of Renovation Builders, webpage Zane Raphael, has been building for over 20 years. Prices range, however a typical mid-range renovation managed by residence renovation contractors in NYC can range from $200–$400 per sq ft, depending on finishes and scope. Our professional staff navigates the method for you, serving to keep away from delays and expensive surprises. With over 20 years of experience as considered one of NYC’s leading reworking firms, MyHome manages all DOB filings and inspections on your behalf.

Kitchen, Rest Room, Full House Reworking & Much More

If you’re in search of a reliable and skilled contractor to assist transform your space, look no further than Grey Renovations LLC. This mindset drives our staff to go above and beyond to exceed your expectations and offer you a really exceptional renovation experience. Welcome to RAM Construction, the premier house, kitchen and loo transforming provider in Anchorage, Alaska. Our Anchorage remodelers are skilled in home additions, rest room additions, kitchen extensions, residence places of work, bump outs, and sunrooms. After purchasing my very own house, I now name Chugach Contracting exclusively for any projects round the house. Hawkinson Development, Inc. is the proper option to be your Anchorage common contractors as we’re dedicated to honesty and integrity within the building industry. What problems did you encounter in your previous building proj

Householders can deduct curiosity on up to $1 million for mortgages originated before this date. Owners can deduct the interest on as a lot as $1 million for mortgages originated earlier than Dec. 16, 2017. For married couples filing individually, each partner can deduct curiosity on up to $375,000 of principal mortgage balances. The IRS incentivizes homeownership by providing tax benefits to individuals who buy houses. For most individuals, it is smart to stay with the usual deduction.

Understanding Home Restore Tax Deductions

If you’re employed for an employer and have a home office, you’re now not eligible to deduct out-of-pocket expenses for working from home. As of 2022, solely self-employed employees can deduct home-office bills. That means when you painted your whole home at a cost of $500, you could deduct $50 as an office expense. In 2021, residence enchancment spending was on the rise, with owners growing their spending by 25 % year over year. In basic, expensive, high-end home improvements repay the least. If you determine your home needs enhancements earlier than you put it on the market, give attention to renovations that provide the most payback.

Aging-in-place And The Medical Expense Tax Deduction

Barring a couple of exceptions, there is no dollar limit for this credit. The big thing to recollect is that the quantity you can deduct is dependent upon whether or not the project impacts the entire house or simply the workplace. Contemplate it an funding in each your wallet and your peace of thoughts; a new report from residence insurance group Hippo tallied that one-third of home owners regretted not doing upkeep or renovations. These exemptions can differ not only in the quantity of tax aid offered but in addition in eligibility standards, so it is essential to do a little bit of analysis. For occasion, maintaining receipts and maintaining a record of bills may be extremely helpful. It Is a good idea to seek the advice of along with your native tax authority or a tax professional to grasp the particular necessities and benefits available to you.

”are Home Enhancements Tax Deductible?”

If you purchase a house and make capital enhancements, hold observe of all prices. Capital enhancements are usually more intensive — and expensive — than repairs. In these circumstances, in case your home’s promoting worth is less than the excluded quantity, a capital enchancment deduction may not have an effect on how a lot you owe. State vitality effectivity incentives are typically not subtracted from qualified prices except they qualify as a rebate or purchase-price adjustment underneath federal revenue tax law. However, utility payments for clear power you promote again to the grid, corresponding to web metering credits, don’t affect your certified bills. Prices of electrical components wanted to assist residential energy property, including panelboards, sub-panelboards, department circuits, and feeders, also qualify for the credit if they meet the National Electrical Code and have a capability of 200 amps or more. A home vitality audit on your main home may qualify for a tax credit score of as much as $150.

Tips For Maximizing Your House Repair Deduct

No listing found.